आईएसटी :18:14:41

- टेक्स्ट का आकार

- In English

- साइट का नक्शा

- मुख्य पृष्ठ

- व्यापार

- खनिज

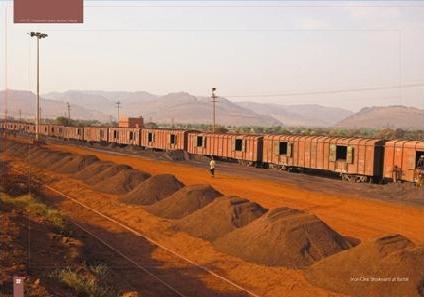

एमएमटीसी वर्तमान में लौह अयस्क फाइन्स और लंप्स, क्रोम अयस्क और कॉन्सेन्ट्रेट, मैंगनीज अयस्क फाइन्स और लंप्स आदि जैसे प्रमुख और लघु खनिजों में कारोबार नहीं कर रहा है।